How Hard Money Loans in Atlanta Can Help You Secure Your Investment Property

How Hard Money Loans in Atlanta Can Help You Secure Your Investment Property

Blog Article

The Benefits of Selecting a Difficult Cash Funding Over Conventional Funding Options

In the realm of real estate investment, the choice between tough cash lendings and standard funding can considerably impact a capitalist's capability to act rapidly and successfully. By concentrating on property value instead than debt scores, these loans allow investors to capitalize on time-sensitive opportunities.

Faster Approval Process

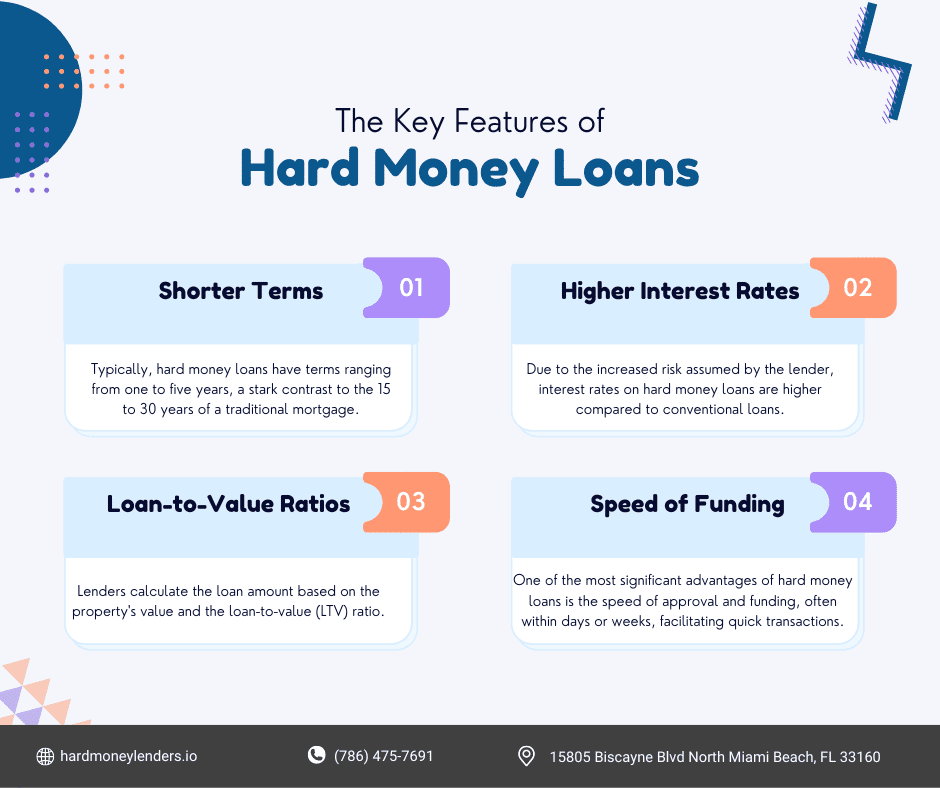

In the world of actual estate financing, the rate of the authorization procedure can considerably affect financial investment decisions. Capitalists typically seek timely accessibility to funds to profit from market possibilities, and conventional funding approaches might not meet these urgent demands. Hard cash lendings, in comparison, commonly offer a structured authorization process that permits borrowers to protect funding promptly.

Unlike conventional loan providers, that may call for extensive documents and extensive credit history assessments, hard cash loan providers base their decisions mainly on the value of the residential or commercial property being funded. hard money loans in atlanta. This asset-based method allows faster authorizations and analyses. Commonly, the turn-around time for hard cash finances can range from a few days to a pair of weeks, relying on the lending institution's plans and the particular conditions of the purchase

Furthermore, this expedited procedure can be particularly useful in competitive realty markets, where the ability to act quickly can identify the success of a financial investment. Financiers that can secure funding promptly are better positioned to confiscate possibilities, negotiate positive terms, and ultimately improve their portfolio performance. In this context, the quicker authorization procedure of hard cash car loans attracts attention as an engaging advantage genuine estate investors.

Flexible Credentials Criteria

The versatile certification criteria of difficult cash lendings work as an additional considerable benefit for capitalists looking for financing solutions. Unlike conventional funding, which usually depends heavily on credit history and considerable paperwork, difficult cash lending institutions prioritize the worth of the home being funded. This approach enables investors, including those with less-than-perfect credit report, to access the capital they need much more easily.

With tough money finances, loan providers typically concentrate on the possession's equity instead of the borrower's financial background. This versatility allows borrowers who might have been averted by traditional banks due to strict requirements to protect financing swiftly. Capitalists can use these financings for numerous projects, including fix-and-flip ventures or business real estate purchases, without the comprehensive red tape connected with standard financing.

Additionally, the structured process often leads to much less documents and faster decision-making, additionally enhancing availability. This is specifically helpful for real estate investors looking to confiscate time-sensitive possibilities. In summary, the versatile credentials standards of hard cash fundings offer a practical financing avenue for those who may otherwise struggle to acquire financing through typical ways, fostering growth and innovation in the investment landscape.

Leverage Residential Or Commercial Property Value

Maximizing residential property worth is a vital approach for capitalists utilizing hard cash finances, as these car loans are basically protected by the property itself. This one-of-a-kind feature enables capitalists to take advantage of the present market worth of their properties to obtain funding that standard lending institutions could not provide. Difficult cash lending institutions concentrate on the asset's value instead of the debtor's creditworthiness, making it possible for investors to gain access to funds swiftly and efficiently.

Capitalists can use the equity of their properties, facilitating the funding of restorations or purchases that can dramatically improve worth. This method is specifically valuable in open markets where timely capital is crucial for securing desirable deals. By leveraging residential or commercial property value, investors can take on jobs that increase rental earnings or resale potential, thereby yielding greater returns on financial investment.

Moreover, the ability to utilize the existing market worth of a residential property gives higher versatility in financing options. Investors can often bargain much better terms based upon boosted property worth, which may include lower rates of interest or reduced charges (hard money loans in atlanta). On the whole, leveraging property worth via tough cash fundings empowers investors to make critical monetary choices that line up with their investment objectives

Short-Term Financing Solutions

Many financiers locate that temporary financing remedies, such as difficult money lendings, give a vital lifeline for seizing prompt opportunities in the realty market. These lendings are especially helpful for those looking to take advantage of time-sensitive deals, such as foreclosure auctions or distressed property purchases that call for quick activity. Unlike traditional financing, which might involve prolonged authorization procedures, difficult cash car loans can usually be secured in a matter of days, allowing capitalists to act promptly and decisively.

On top of that, the reliance on residential property worth rather than customer creditworthiness indicates that capitalists with less-than-perfect try this website credit rating can still secure the needed resources. This particular makes temporary funding an attractive option for seasoned investors and newbies alike.

Streamlined Paperwork Demands

Structured documentation is one of the key benefits of tough money car loans, making them especially attracting investor. Unlike traditional funding alternatives, which usually call for comprehensive paperwork, hard cash financings focus mainly on the value of the home being utilized as security. This change in emphasis enables capitalists to bypass the prolonged approval processes normally linked with financial institutions and lending institution.

Tough money lending institutions normally require very little paperwork, which might include proof of revenue, a residential or commercial property evaluation, and a basic funding application. This streamlined method speeds up the funding timeline, enabling investors to take chances promptly, specifically in open markets. The lowered documents needs minimize the workload for candidates, allowing them to focus on their financial investment strategies instead than paperwork.

Basically, the streamlined paperwork process not just speeds up accessibility to resources but likewise gives a degree of flexibility that conventional lenders commonly do not have. For those aiming to finance property jobs successfully, hard money lendings provide a feasible option, incorporating swift approvals with simple demands that deal with the dynamic nature of realty investing.

Final Thought

In the realm of real estate investment, the choice between hard money fundings and traditional funding can substantially impact a capitalist's capability to act swiftly and efficiently.Maximizing residential property worth is an essential technique for capitalists making use of difficult cash financings, as these finances are basically original site protected by the company website real estate itself.Lots of investors discover that short-term funding services, such as tough money loans, supply an essential lifeline for confiscating immediate opportunities in the actual estate market. Unlike standard funding, which may include prolonged approval procedures, tough money lendings can often be protected in an issue of days, enabling financiers to act quickly and decisively.

Report this page